tax loss harvesting rules

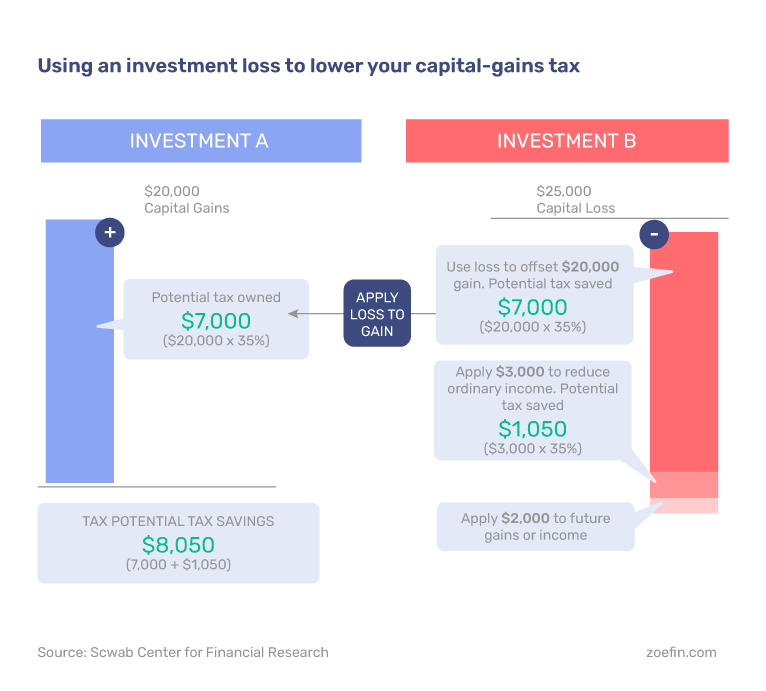

Then the investment loss can potentially be used to reduce the taxes you pay on investment gains you might have or to reduce your other taxable income allowing greater potential benefit to you. There are restrictions on using specific types of losses to offset certain gains.

Reap The Benefits Of Tax Loss Harvesting

To claim a loss for tax purposes.

. Tax loss harvesting is a powerful tool that can save you thousands of dollars in taxes. Tax rules in the US. To recap when investors sell a stock for a profit they must pay federal capital gains tax which has two rates.

In addition you also can use your losses to offset the tax owed on up. How to Avoid Violating Wash Sale Rules When Realizing Tax Losses. Tax loss harvesting is an investing strategy that can turn a portion of your investment losses into tax offsets helping turn financial losses into wins.

The strategy known as tax-loss harvesting allows you to sell declining assets from your brokerage account and use the losses to reduce other profits. It is typically used to limit the recognition of short-term capital gains which are. Claim the loss on line 7 of your Form 1040 or Form 1040-SR.

10 RULES FOR INVESTING 20 RULES FOR SPOTTING MARKET BOTTOMS 5 RULES FOR TRADING DURING EARNINGS SEASON MANAGING YOUR. Wash sales occur when you sell a security at a loss and when you your spouse or one of your IRAs buys the same or a substantially. IRA within 30 days before or after the sale that loss will be subject to the wash-sale rules.

First if those shares produced any tax-exempt interest then the loss is reduced dollar for dollar by. Understanding the Wash Sale Rules On Tax Loss Harvesting TLH The so-called wash sale rules are one of the oldest anti-abuse provisions of the Internal Revenue Code first originating with the Revenue Act of 1921 and substantively codified in the current IRC Section 1091 as a part of the general overhaul in developing the Internal Revenue Code of 1954. In fact by keeping careful track of your returns you can potentially save money using a method called tax loss harvesting.

This rule prohibits you from selling an investment to book a capital loss to reduce your tax bill and immediately repurchasing it. Once losses exceed gains you can use the. Tax-loss harvesting rules to know You wont find any specific reference to tax-loss harvesting in the 45000 words the IRS devotes to investment income and expenses in Publication 550.

And those shares have been held for 6 months or less then there are special rules that may alter the loss you claim. A related term tax-loss harvesting is selling an investment at a loss with the intention of ultimately repurchasing the same investment after the IRSs 30 day window on wash sales has expired. Crypto Taxes in 2022.

Stated simply tax-loss harvesting means selling an investment that has lost value and purchasing another security to replace it. Tax Rules for Bitcoin and Others. If a wash sale occurs you cannot use any of the capital loss to reduce your taxes.

If you have a large net loss such as 20000 then it would take you seven years to deduct it all against other forms of income a 3000 loss every year for 6 years and a 2000 loss in the. Tax-loss harvesting is the selling of securities at a loss to offset a capital gains tax liability in a very similar security. One of the most important rules surrounding tax-loss harvesting is the wash sale rule.

There are rules to keep in mind while. The Internal Revenue Service IRS allows single filers and married couples filing jointly to deduct up to 3000 in realized losses from their ordinary income. The utilization of realized losses may be limited by a number of special rules in the IRC in particular by the wash sale rules.

Wash sales are a method investors employ to. The minimal tax deferral value of harvesting losses Tax-loss harvesting is often framed as a simple matter of selling an investment for less than the owner originally paid for it but in practice. Tax-loss harvesting TLH is a strategy to lower current taxes paid to the US.

The benefits and mechanics of automated tax-loss harvesting and rebalancing. Investors may be able to claim up to 3000 in capital losses per year in. Set us as your home page and never miss the news that matters to you.

As with any tax-related topic there are rules and limitations. Tax-loss harvesting can be a silver lining for taxpayers but not always. Tax gainloss harvesting is a strategy of selling securities at a loss to offset a capital gains tax liability.

Tax loss harvesting is a technique to improve the after-tax return of your taxable investments. I show a step by step example of a tax loss harvest with Vanguard. Tax-loss selling is an investment strategy that can help an investor reduce their taxable income for a given tax year.

A long-term loss would first be applied to. The rules only deal with the tax treatment of capital losses and the accounting of the ongoing tax basis. If your net capital loss is more than.

A wash sale is a transaction where an investor sells a losing security to claim a capital loss only to repurchase it again for a bargain. You can fully offset the tax owed on your 10000 capital gain with 10000 of your capital losses on your 2022 tax return. Federal government by deliberately selling an investment at a lossie deliberately taking a capital lossin.

Long-term if you held the stock for at least a year and a day 0 15 or 20. If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately or your total net loss shown on line 16 of Schedule D Form 1040. Tax-loss harvesting isnt useful in retirement accounts such as a 401k or an IRA because you cant deduct the losses generated in a tax-deferred account.

Tax Loss Harvesting Definition Example How It Works

Year Round Tax Loss Harvesting Benefits Onebite

Turning Losses Into Tax Advantages

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Tax Loss Harvesting Napkin Finance

What Is Tax Loss Harvesting Ticker Tape

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

How To Tax Loss Harvest At Vanguard With Screenshots White Coat Investor

Tax Loss Harvesting Napkin Finance

Turning Losses Into Tax Advantages

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Everything You Should Know

Do S And Don Ts Of Tax Loss Harvesting Zoe

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management